Financial Insights: Navigating Taxes and Money Matters

Welcome to 'Financial Insights: Navigating Taxes and Money Matters' – your essential resource for expert advice and updates on tax regulations, financial planning, and smart money management. Our blog provides clear, actionable insights to help individuals and businesses make informed decisions and stay ahead in the ever-evolving financial landscape. Whether you're tackling tax season or strategizing for long-term financial success, we're here to guide you through every step of your financial journey.

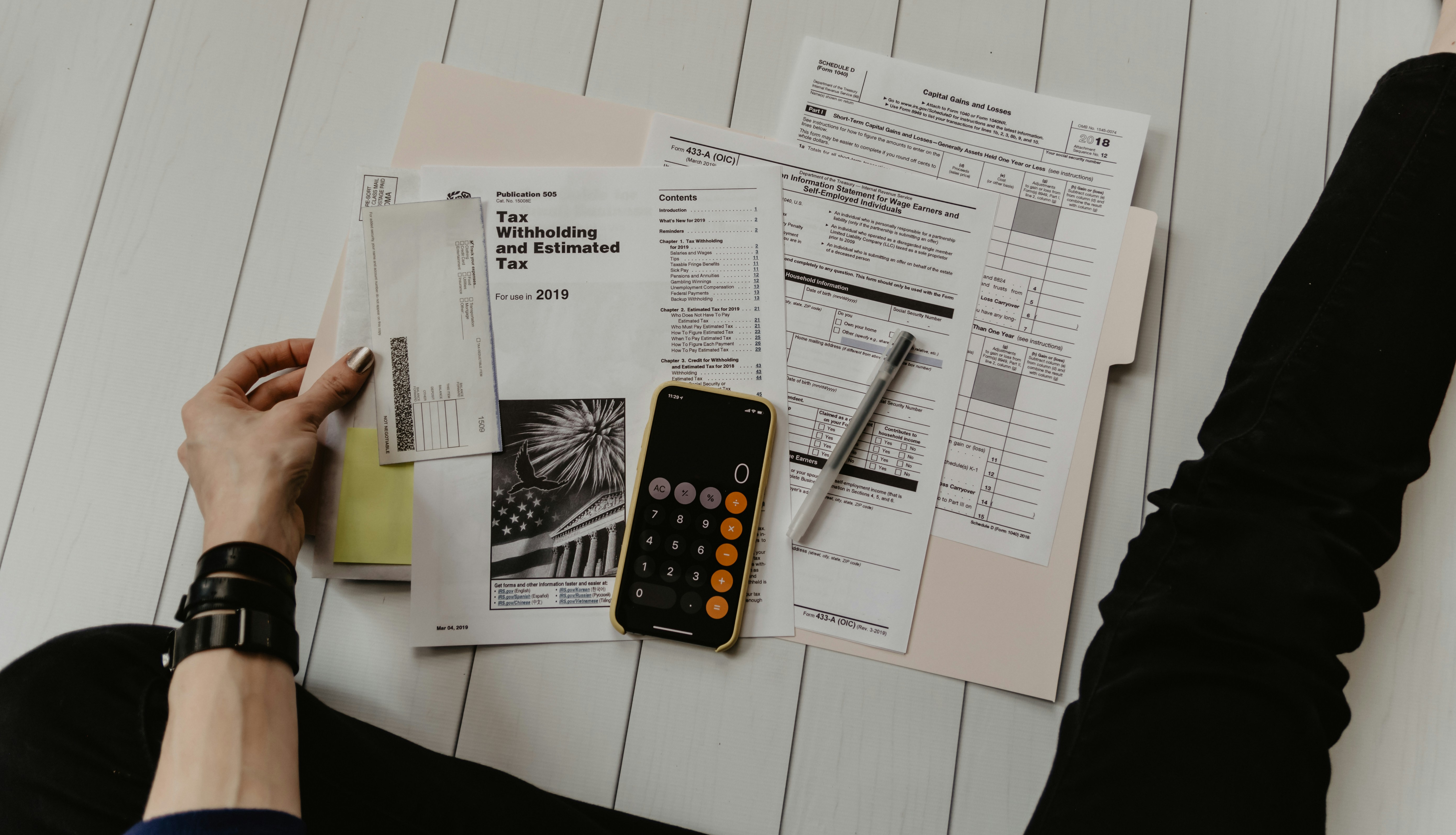

Why Early Tax Preparation is Key: Schedule Your Appointment Now

The Risks of Last-Minute Tax Filing

1. Increased Risk of Mistakes

When you're in a rush, the likelihood of making errors in your tax returns escalates. These mistakes can range from simple computational errors to missing out on important deductions or credits.

2. Added Stress

Filing taxes can be stressful, and this stress is amplified when you're working against a tight deadline. This can lead to rushed decisions and overlooked details.

3. Potential Delays in Refunds

Filing closer to the deadline can delay the processing of your return, especially if corrections are needed. This means you might have to wait longer for any refunds you're owed.

The Advantages of Early Tax Preparation

1. Ample Time for Thorough Review

By starting early, you give yourself the time to carefully gather and review all necessary documents, ensuring nothing is missed.

2. Opportunity for Better Planning

Early preparation allows for more strategic thinking about deductions and credits, potentially leading to a more favorable tax outcome.

3. Access to Professional Help

Scheduling your tax appointment early ensures you get timely access to professional assistance, which can be harder to come by as the tax deadline approaches.

Schedule Your Tax Appointment Today

We're excited to announce that you can now schedule your tax appointment with us. By doing so, you're taking a proactive step towards a hassle-free tax filing experience. Our team of experts is ready to guide you through the process, ensuring accuracy and maximizing your tax benefits.

Conclusion

Don't wait until tax time to get your affairs in order. Early preparation is key to a stress-free and successful tax season. Schedule your appointment with us today and experience the difference it makes.

Download Our Free Tax Prep List Here

I agree to terms & conditions provided by the company. By providing my email, I agree to receive emails from the business.