Introduction:

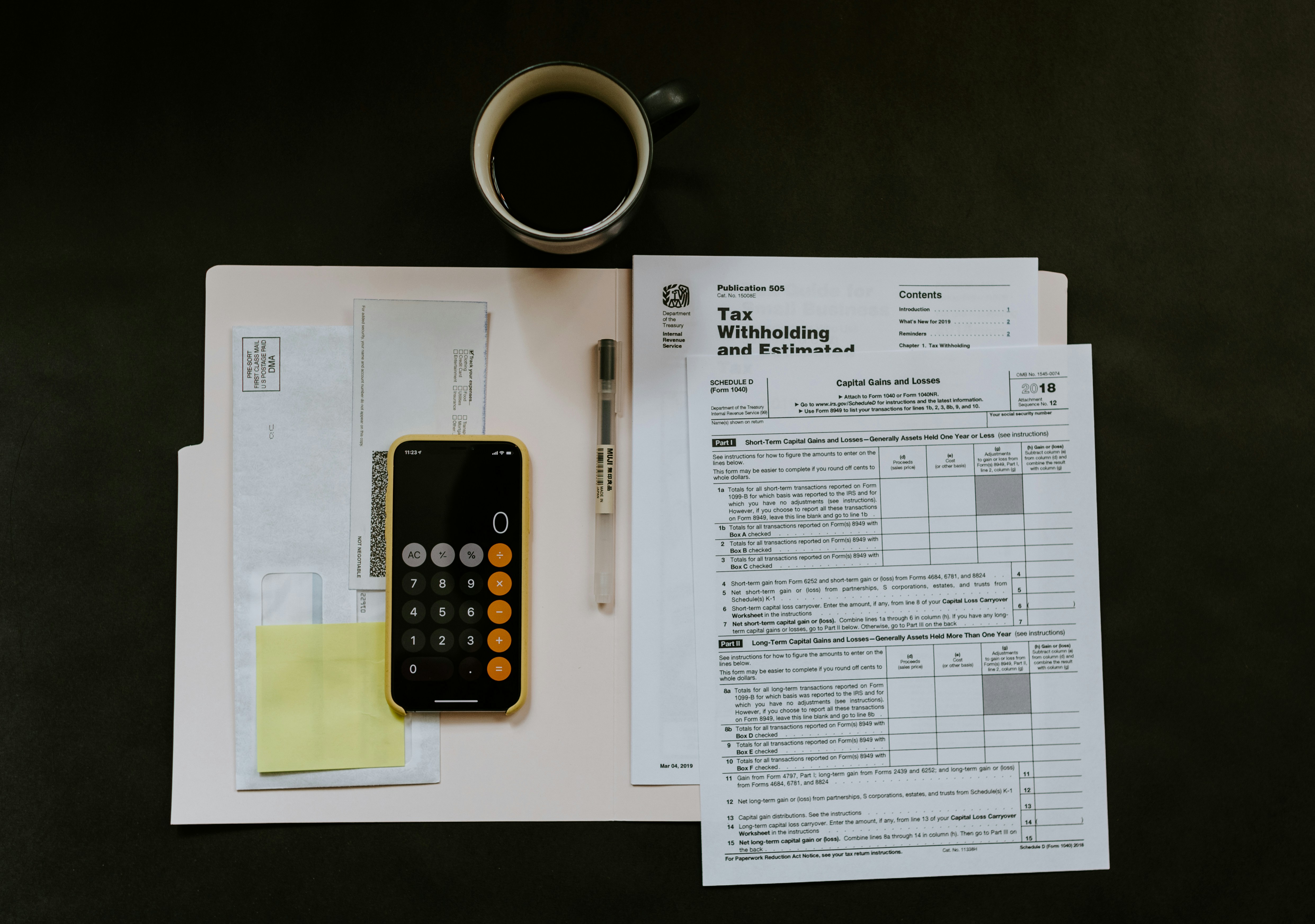

Tax season is upon us, and with it comes the need to understand the intricate dance of filing tax returns. The Internal Revenue Service (IRS) marks January 29th as the official date to begin accepting individual tax returns and January 16th for business tax returns. Navigating through the labyrinth of forms like 1040 for individuals and various others for businesses can be daunting. This guide aims to simplify this process, ensuring you're well-prepared for the upcoming tax season.

Key Takeaways

Essential dates for IRS tax return acceptance.

Differences between individual and business tax returns.

Key information on Form 1040 and business-specific forms.

Understanding the IRS Tax Acceptance Schedule

The IRS calendar is a critical aspect of financial planning for both individuals and businesses. Individual tax returns, including those for sole proprietors, begin on January 29th, while business entities start their filing process on January 16th. This distinction is vital for timely and accurate filing. Understanding the nuances between individual and business tax categories helps in aligning with IRS expectations and avoiding common pitfalls.

Individual Tax Returns: Focus on Form 1040

Form 1040 is the cornerstone of individual tax returns, encapsulating the financial portrait of a sole proprietor or an individual taxpayer. It's crucial to accurately report income, expenses, and possible deductions here. Sole proprietors, often overlooked, are part of this category and must adhere to the specifics of Form 1040. In this segment, we'll delve into the intricacies of this form, highlighting crucial credits like the Earned Income Tax Credit (EITC) and Child Tax Credit, which can significantly impact your tax responsibilities.

Business Tax Returns: Forms 1065, 1120s, & 1120

Transitioning to business tax returns, each entity type has its designated form: Partnerships file Form 1065, S Corporations use Form 1120S, and regular Corporations file Form 1120. These forms cater to the unique financial structures of each entity. It's not just about filling out the right form; understanding each form's specific requirements is key to a compliant and beneficial tax filing experience.

Filing Tips and Best Practices for Individuals and Businesses

Navigating the tax season requires more than just knowing the deadlines. It's about accuracy, understanding the nuances of tax laws, and making sure you're maximizing your benefits while staying compliant. For individuals, especially sole proprietors, this means keeping meticulous records and understanding how personal and business finances intersect. For businesses, it's about comprehending the complexities of their specific tax forms and regulations. This section offers valuable tips and strategies to ensure a smooth and error-free filing experience.

Tax Deductions and Credits for Businesses

One of the most significant aspects of business tax filing is understanding the array of deductions and credits available. From Clean Energy and Vehicle Credits to retirement plan contributions, these can substantially reduce tax liabilities. We'll explore these deductions and credits, providing insights on how to leverage them for maximum financial benefit for your business.

FAQs

What are the key differences between individual and business tax returns?

Understanding the distinctions between these two types of returns is crucial for accurate filing. This section answers this question in detail, helping taxpayers differentiate and navigate through their specific requirements.

How can sole proprietors effectively file their taxes?

Sole proprietors face unique challenges in tax filing, often merging personal and business finances. Here, we break down the process, making it simpler and more efficient for sole proprietors to file their taxes.

What are the specific deadlines for various business tax forms?

Meeting deadlines is vital to avoid penalties. This FAQ section provides a comprehensive list of deadlines for various business tax forms, ensuring businesses stay on track.

Conclusion

As we wrap up our comprehensive guide on the IRS tax return acceptance dates and requirements for 2024, remember that staying informed and prepared is key to a successful tax season. Whether you're an individual taxpayer or a business entity, understanding your obligations, available deductions, and credits can make a significant difference. Don't hesitate to seek professional advice or assistance to navigate through this season effectively.